does texas have state inheritance tax

The good news is that texas doesnt impose an estate or inheritance tax. If youre a resident of Texas this means that you wont have to pay the.

Texas A M Study Tax Code Changes Would Devastate Family Farms

Finding Information About Taxes On Interest An initial gift of money or property is tax-free but if it earns any income for.

. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. The state of Texas does not have an inheritance tax. Before 1995 Texas collected a separate inheritance tax called a pick-up tax.

In Texas as well as nationwide if you are a named beneficiary of an individual retirement arrangement. Texas is one of a handful of states that does not have an inheritance tax. There is a 40 percent federal tax however on estates over.

Twelve states and Washington DC. Fourteen states and the District of Columbia impose an. However if a loved one who lives in another state leaves you money you may be subject to inheritance taxes in.

There is a big exception to the no inheritance tax rule however. However in texas there is no such thing as an inheritance tax. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

In addition to the federal estate tax of 40 percent some states impose an additional estate or inheritance tax. However other stipulations might mean youll still get taxed on an inheritance. The state has a low income tax and is not regulated in a way that can lead to an estate or inheritance.

In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. This is because the amount is. When someone dies their estate goes through a legal process known as probate.

Before breathing too big a sigh of relief Texan beneficiaries need to be aware that although Texas has no inheritance tax assets may still be subject to state inheritance taxes. However a Texan resident who inherits a property from a state that does have such tax will still be responsible. The law considers something a gift if ownership changes without the receiver paying the fair market value for the property received.

Inheritance Tax In Texas. There are not any estate or inheritance taxes in the state of Texas. The good news is that texas doesnt impose an estate or inheritance tax.

Federal estatetrust income tax return. Texas has no inheritance tax so any money you receive as a beneficiary is not charged state tax income tax property tax or capital gains tax. Your estate may be subject to the federal estate tax While there is no state inheritance tax in Texas.

T he short answer to the question is no. The tax did not increase the total amount of estate tax. There is no inheritance tax in Texas.

There is a 40 percent federal tax however on estates over. On the one hand Texas does not have an inheritance tax. The short answer is no.

Gift Taxes In Texas.

State By State Estate And Inheritance Tax Rates Everplans

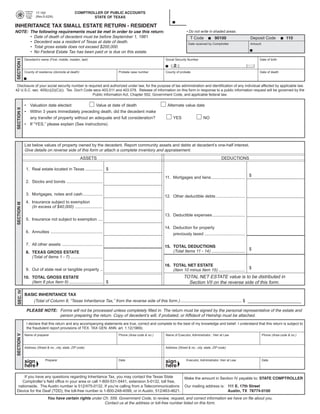

Texas Inheritance Tax Forms 17 100 Small Estate Return Resident

Texas Has 7th Highest Property Taxes In The Us Report States Keye

Property Taxes By State 2016 Eye On Housing

Cost Of Dying Demystifying The Estate Tax How Money Walks How 2 Trillion Moved Between The States A Book By Travis H Brown

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Estate Inheritance Taxes In Texas Vs California

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

How Much Can You Inherit Without Paying Taxes In Us By State In 2022 As Usa

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

The Ultimate Texas Estate Tax Guide Top 10 Strategies

:max_bytes(150000):strip_icc()/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated And Who Pays It

Estate Tax Rates Forms For 2022 State By State Table

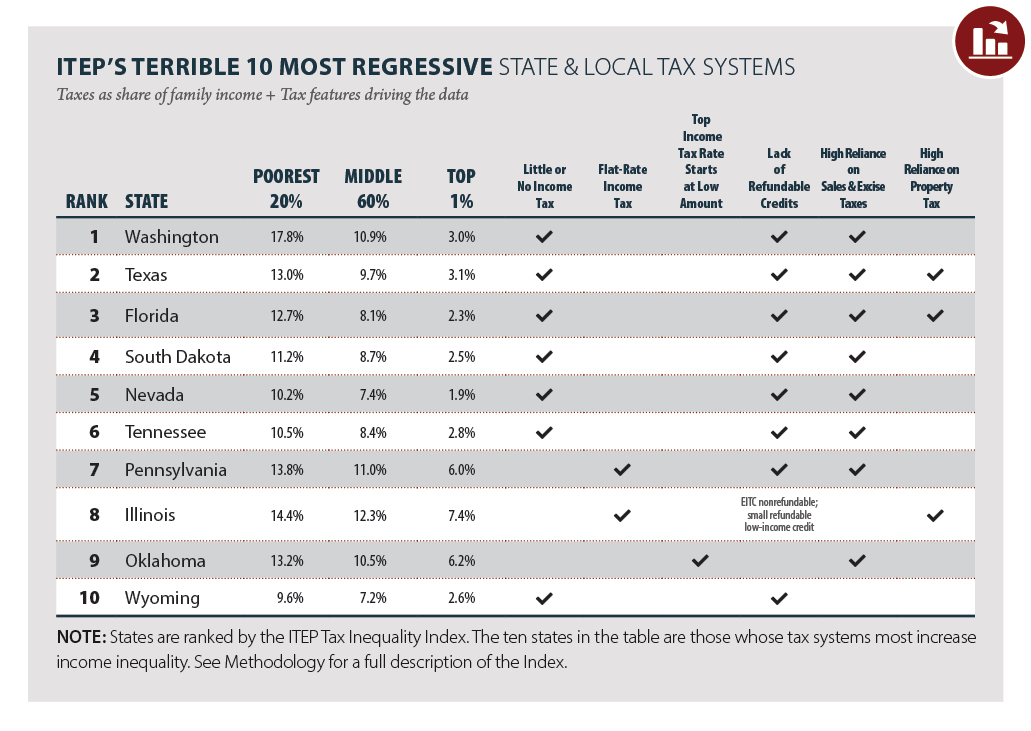

State Estate And Inheritance Taxes Itep

3 Transfer Taxes To Avoid In Your Houston Estate Plan